Structure products or Market linked Debentures (MLDs) are structured fixed income products which pays the principal and market linked returns on maturity. The returns are linked to performance of specific market indexes e.g. Nifty, Gold, and G-Sec etc, as specified by the issuer.

Example

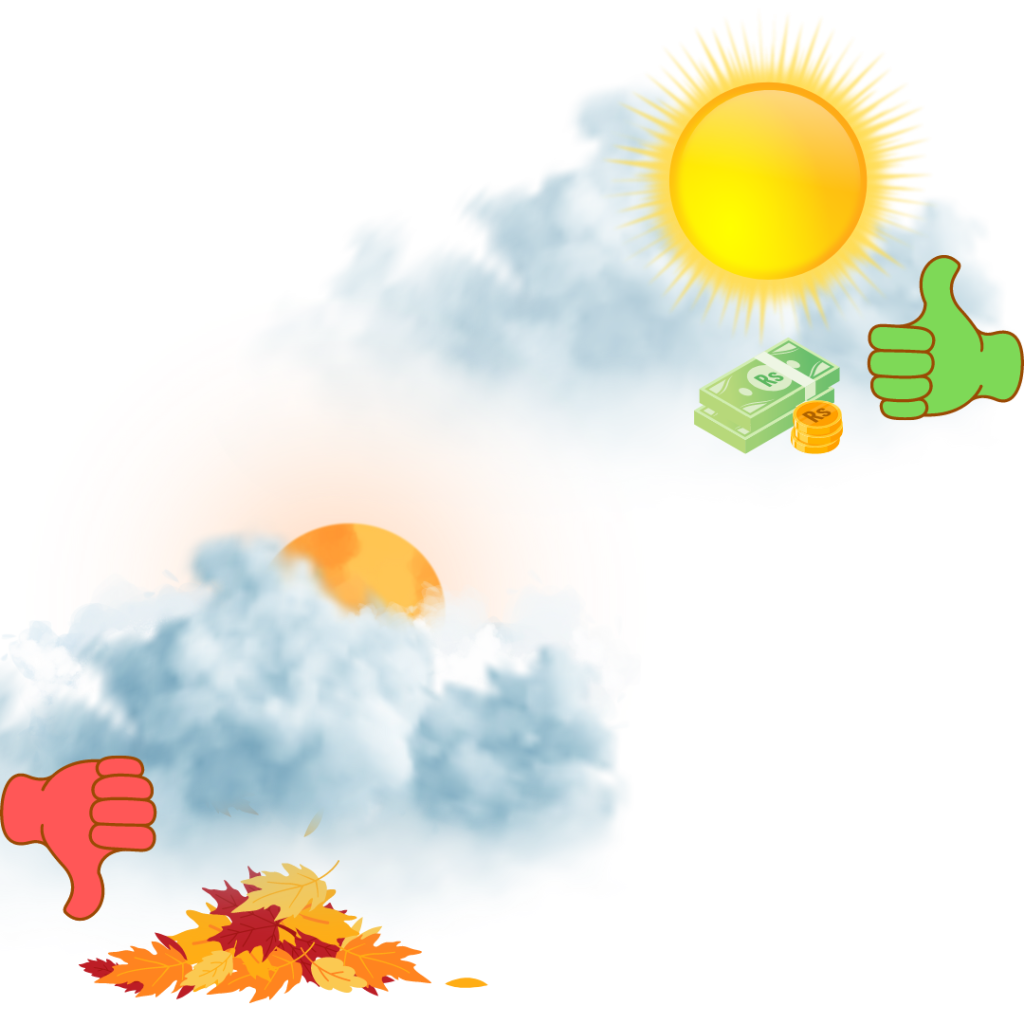

If it’s sunny on your maturity date, you get 8%. If it’s cloudy, you get 6%.

You’re going to bet on the weather for a different return. Effectively, that’s what a structure product or a market linked debenture (MLD) is, except they don’t link it to the weather; they link it to something that’s in the market – like a government bond or an index.