BASKET

CONSERVATIVE

PORTFOLIO

A conservative portfolio is an investment strategy that emphasizes capital preservation, low risk, and stable income generation. This type of portfolio typically includes a high proportion of fixed-income securities such as government and high-quality corporate bonds, along with a smaller allocation to low-risk equities, such as blue-chip or dividend-paying stocks. The primary goal is to protect the principal investment while achieving modest, predictable returns with minimal volatility.

Characteristics

Low risk

Focuses on reducing exposure to market fluctuations

Stable Returns

Aims for consistent and reliable income

High-Quality SP

Invested in high grade Structured Products

Limited Equity Exposure

Contains a small percentage of low risk stocks

Diversification

Spread across various assets to mitigate risk

1. Individuals nearing or in retirement

2. Risk-averse investors

3. Those seeking capital preservation over high returns

4. People with short to medium-term financial goals

5. Investors prioritizing stability and income over growth

If you fall in the above category then our Conservative basket is the right choice for you

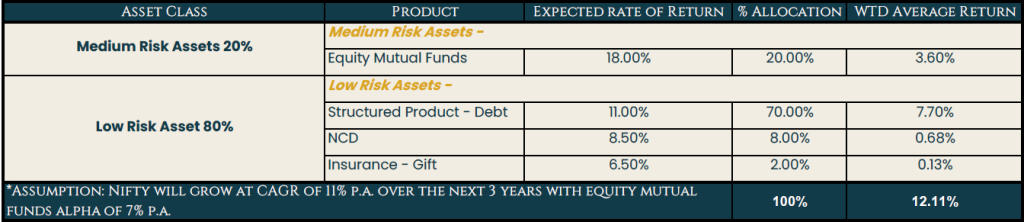

Portfolio Composition