BASKET

BALANCED

PORTFOLIO

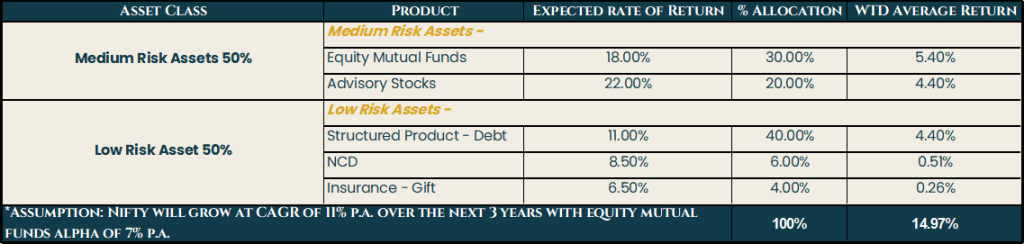

A balanced portfolio is an investment strategy designed to achieve a moderate level of risk and return by diversifying assets across both equities (stocks) and fixed-income securities (bonds). This type of portfolio aims to provide a balance between growth and income, combining the potential for capital appreciation from stocks with the stability and income generation of bonds. The typical allocation for a balanced portfolio is roughly 50% equities and 50% fixed-income securities, though this can vary based on individual risk tolerance and investment goals.

Characteristics

mODERATE risk

Balances risk and potential returns through diversification

Adaptability

Adjusted based on the investor’s changing risk tolerance and financial goals

Equity-Bond Mix

Typically includes a roughly equal allocation to Equity and Debt

Growth and Income

Aims to achieve both capital appreciation and income generation

Diversification

Spreads investments across multiple asset classes to manage risk

1. Moderate Risk Tolerance Investors

2. Middle-Aged Investors

3. Dual Goal Investors

4. Diversification Seekers

5. Financial Goal Planners

If you fall in the above category then our Balanced basket is the right choice for you

Portfolio Composition