BASKET

MODERATELY

AGGRESSIVE

PORTFOLIO

A moderately aggressive portfolio is an investment strategy aimed at achieving higher returns by taking on a greater degree of risk compared to conservative or balanced portfolios. It typically includes a significant allocation to equities (stocks) and a smaller portion to fixed-income securities (bonds). This type of portfolio seeks to capitalize on market growth while still maintaining some level of stability through diversification.

Characteristics

HIGHER

RISK-REWARD

Targets higher returns by accepting increased market volatility

Growth Oriented

Emphasizes capital appreciation with a larger allocation to equity

Moderate Income

Includes some debt and other fixed income securities for stability and income.

Long-Term Focus

Investors with a long-term view willing to ride out market fluctuations.

Diversification

Spreads investments across asset classes to manage risk

1. Growth-Oriented Investors

2. Long-Term Investors

3. Younger Investors

4. Risk Tolerant Investors

5. Goal-Oriented Savers

If you fall in the above category then our Moderately Aggressive basket is the right choice for you

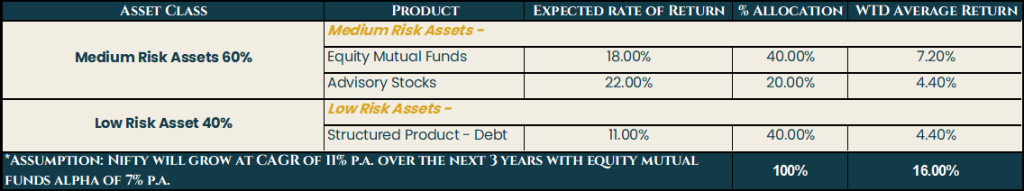

Portfolio Composition