BASKET

AGGRESSIVE

PORTFOLIO

An aggressive portfolio is an investment strategy focused on achieving high returns by taking on substantial risk. This type of portfolio predominantly consists of equities, particularly those of growth-oriented and potentially high-performing companies, with minimal allocation to fixed-income securities. The goal is capital appreciation, often at the expense of greater volatility and risk.

Characteristics

HIGH

RISK-REWARD

Aims for significant capital appreciation with a tolerance for substantial market fluctuations

Equity

Dominant

Major allocation to small-cap, emerging markets, and high growth sectors

Minimal Fixed Income

Limited allocation to bonds or other low risk assets in debt asset

Volatility Acceptance

Prepared for significant short term value swings

Long-Term Focus

Suitable for investors who can weather market downturns

1. High Risk Tolerance Investors

2. Young Investors

3. Growth-Oriented Investors

4. Experienced Investors

5. Long-Term Goal Seekers

If you fall in the above category then our Aggressive basket is the right choice for you

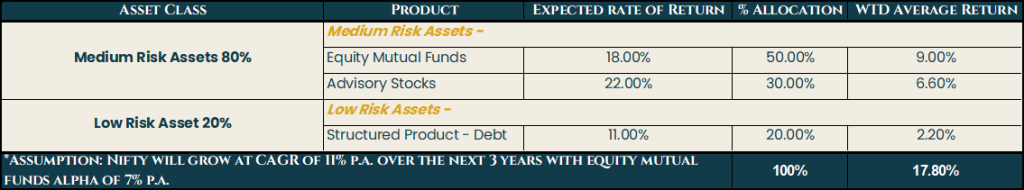

Portfolio Composition