BASKET

MODERATELY

CONSERVATIVE

PORTFOLIO

A moderately conservative portfolio is an investment strategy that balances the goals of capital preservation and income generation with modest growth potential. It seeks to minimize risk while allowing for some appreciation by combining a higher proportion of fixed-income securities with a modest allocation to equities and other growth-oriented investments. This approach aims to achieve more growth than a purely conservative portfolio, but with less volatility than a more aggressive strategy.

Characteristics

Balanced Risk

Strikes a balance between low risk and modest growth potential

Stable Income

Emphasizes income generation through bonds and dividend paying stocks

Growth

Includes a moderate allocation to equities for capital appreciation

Preservation

Protecting the principal while seeking additional returns

Diversification

Spread across various assets to mitigate risk

1. Individuals approaching retirement who still seek some growth

2. Willing to accept modest equity exposure for higher returns

3. Seeking a balance between capital preservation and growth

4. Those with medium-term financial goals

5. Looking for stable income with capital appreciation

If you fall in the above category then our Moderately Conservative basket is the right choice for you

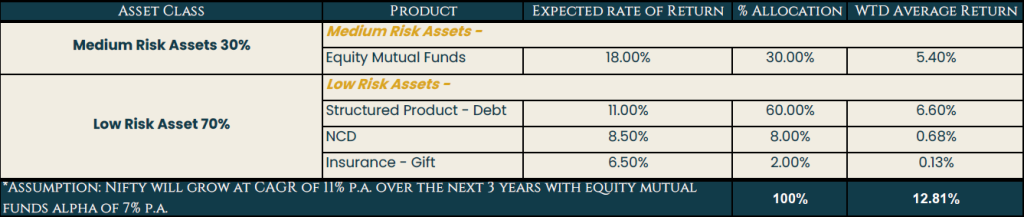

Portfolio Composition